Creating a prior distribution for audit sampling

Koen Derks

Source:vignettes/articles/creating-prior.Rmd

creating-prior.RmdIntroduction

This vignette will walk you through the process of setting up a prior

distribution for audit sampling using the auditPrior()

function in the jfa package.

The power of Bayesian statistics lies in its ability to incorporate pre-existing information about the misstatement into the sampling procedure through the prior distribution. Once data is observed, the prior information is updated to draw an overall conclusion about the misstatement in the population. The use of a prior distribution has the advantage of making the underlying assumptions explicit, potentially reducing the amount of audit work needed to achieve the desired assurance. The type of information that can be incorporated into the prior distribution depends on the availability and quality of the information, as well as the specifics of the audit.

For example, if you have information from the auditee’s internal control systems indicating well-segregated duties and numerous effective controls in place, this suggests a relatively low probability of misstatement. This risk-mitigating information can be incorporated into the prior distribution, thereby lessening the need for evidence from the sample. It is important to note that all information integrated into the prior distribution should be substantiated with appropriate and sufficient audit evidence. Specifically, the auditor should be able to justifying the translation of audit information into a prior distribution. This vignette addresses this issue.

Creating a prior distribution

The auditPrior() function is used to define a prior

distribution for audit sampling. The following are various ways this

function can be used to construct a prior distribution.

Default priors

The default prior distributions in jfa are specified

using method = 'default'. These default priors meet two

criteria: 1) they hold relatively minimal information about the

population misstatement, and 2) they are proper, meaning they integrate

to one.

-

likelihood = 'poisson': gamma( = 1, = 1) -

likelihood = 'binomial': beta( = 1, = 1) -

likelihood = 'hypergeometric': beta-binomial(N, = 1, = 1) -

likelihood = 'normal': normal( = 0, = 1000) -

likelihood = 'uniform': uniform(min = 0, max = 1) -

likelihood = 'cauchy': Cauchy( = 0, = 1000) -

likelihood = 't': Student-t(df = 1) -

likelihood = 'chisq': chi-squared(df = 1) -

likelihood = 'exponential': exponential( = 1)

prior <- auditPrior(method = "default", likelihood = "binomial")

summary(prior)##

## Prior Distribution Summary

##

## Options:

## Likelihood: binomial

## Specifics: default prior

##

## Results:

## Functional form: beta(α = 1, β = 1)

## Mode: NaN

## Mean: 0.5

## Median: 0.5

## Variance: 0.083333

## Skewness: 0

## Information entropy (nat): 0

## 95 percent upper bound: 0.95

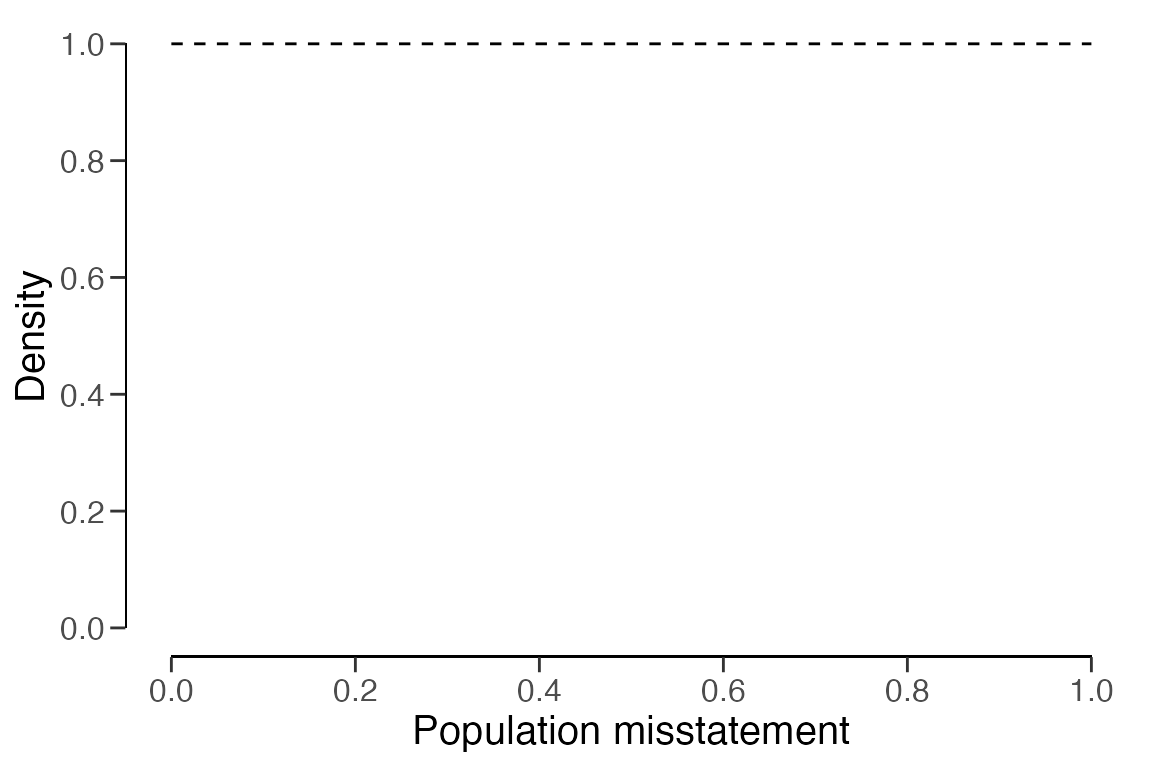

## Precision: NaNAfter setting up the prior distribution, you can visually examine it

using the plot() function.

plot(prior)

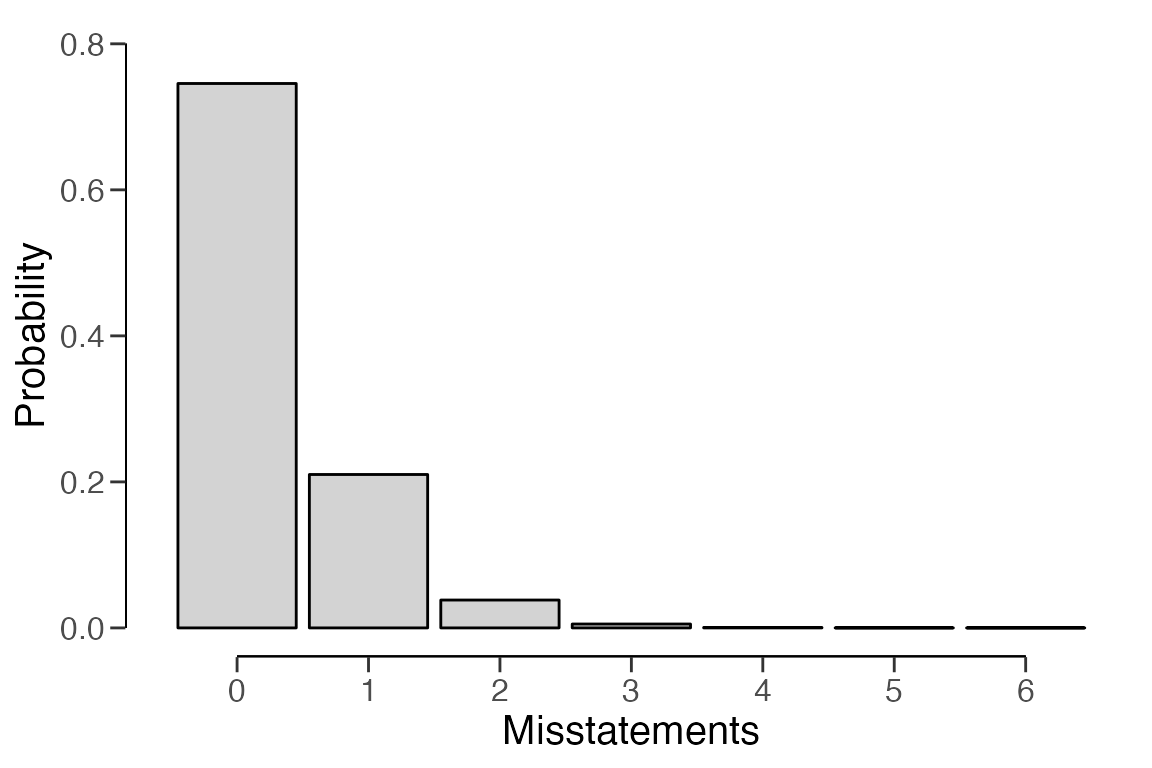

Additionally, the predict() function generates the

predictions of the prior distribution at the data level for a sample of

items. For instance, the command below calls for the prediction of the

default beta(1, 1) prior for a hypothetical sample of

= 6 items.

predict(prior, n = 6)## x=0 x=1 x=2 x=3 x=4 x=5 x=6

## 0.1428571 0.1428571 0.1428571 0.1428571 0.1428571 0.1428571 0.1428571You can visualize the predictions of the prior distribution using the

plot() function.

Priors with custom parameters

You can manually set the parameters of the prior distribution using

method = 'param' along with the alpha and

beta arguments. These correspond to the first and

(optionally) second parameter of the prior distribution as shown in the

default prior section. For instance, the commands below will create a

beta(2, 10) prior distribution, a normal(0.025, 0.05) prior

distribution, and a Student-t(0.01) prior distribution.

auditPrior(method = "param", likelihood = "binomial", alpha = 2, beta = 10)##

## Prior Distribution for Audit Sampling

##

## functional form: beta(α = 2, β = 10)

## parameters obtained via method 'param'

auditPrior(method = "param", likelihood = "normal", alpha = 0.025, beta = 0.05)##

## Prior Distribution for Audit Sampling

##

## functional form: normal(μ = 0.025, σ = 0.05)T[0,1]

## parameters obtained via method 'param'

auditPrior(method = "param", likelihood = "t", alpha = 0.01)##

## Prior Distribution for Audit Sampling

##

## functional form: Student-t(df = 0.01)T[0,1]

## parameters obtained via method 'param'Improper priors

An improper prior distribution with classical properties can be

constructed using method = 'strict'. The posterior

distribution from this prior produces the same results as the classical

methodology in terms of sample sizes and upper limits. However, it only

becomes proper once a single non-misstated item is present in the sample

(Derks et al., 2022). The command below

creates an improper beta(1, 0) prior distribution.

Note: This method requires the poisson,

binomial, or hypergeometric

likelihood.

auditPrior(method = "strict", likelihood = "binomial")##

## Prior Distribution for Audit Sampling

##

## functional form: beta(α = 1, β = 0)

## parameters obtained via method 'strict'Impartial priors

To incorporate the assumption that tolerable misstatement is equally

likely as intolerable misstatement (Derks et al.,

2022), you can use method = 'impartial'. For

instance, the command below generates an impartial beta prior

distribution for a performance materiality of five percent.

Note: This method requires a value for the

materiality and the poisson,

binomial, or hypergeometric

likelihood.

auditPrior(method = "impartial", likelihood = "binomial", materiality = 0.05)##

## Prior Distribution for Audit Sampling

##

## functional form: beta(α = 1, β = 13.513)

## parameters obtained via method 'impartial'Priors based on risk of material misstatement

To manually set prior probabilities for the hypothesis of tolerable

misstatement and the hypotheses of intolerable misstatement (Derks et al., 2021), you can use

method = 'hyp' in conjunction with the p.hmin

argument. For instance, the command below integrates the information

that the hypothesis of intolerable misstatement has a 40 percent

probability into a beta prior distribution. This is equal to setting the

risk of material misstatement (RMM) to 40 percent.

Note: This method requires a value for the

materiality and the poisson,

binomial, or hypergeometric

likelihood.

auditPrior(method = "hyp", likelihood = "binomial", materiality = 0.05, p.hmin = 1 - 0.4)##

## Prior Distribution for Audit Sampling

##

## functional form: beta(α = 1, β = 17.864)

## parameters obtained via method 'hyp'Priors based on the Audit Risk Model

To convert risk assessments from the Audit Risk Model, including

inherent risk and internal control risk, into a prior distribution (Derks et al., 2021), you can use

method = 'arm' along with the ir and

cr arguments. For instance, the command below integrates

the information that the inherent risk is 90 percent and the internal

control risk is 60 percent into a beta prior distribution.

Note: This method requires the poisson,

binomial, or hypergeometric

likelihood.

auditPrior(method = "arm", likelihood = "binomial", materiality = 0.05, ir = 0.9, cr = 0.6)##

## Prior Distribution for Audit Sampling

##

## functional form: beta(α = 1, β = 12)

## parameters obtained via method 'arm'Priors based on the Bayesian Risk Assessment Model

Incorporating information about the most likely value and the upper

limit of the population misstatement can be done using

method = 'bram'. For instance, the following code

demonstrates how to embed the information that the most likely

misstatement in the population is one percent and the 95 percent upper

limit on this misstatement is 60 percent into a beta prior

distribution.

Note: This method requires the poisson,

binomial, or hypergeometric

likelihood.

auditPrior(method = "bram", likelihood = "binomial", expected = 0.01, materiality = 0.05, ub = 0.6)##

## Prior Distribution for Audit Sampling

##

## functional form: beta(α = 1.023, β = 3.317)

## parameters obtained via method 'bram'Priors based on an earlier sample

You can use the method = 'sample' along with the

x and n arguments to integrate information

from an earlier sample into the prior distribution (Derks et al., 2021). For instance, the code

below demonstrates how to include the data from a previous sample of

= 30 items where

= 0 misstatements were detected into a beta prior distribution.

Note: This method requires the poisson,

binomial, or hypergeometric

likelihood.

auditPrior(method = "sample", likelihood = "binomial", x = 0, n = 30)##

## Prior Distribution for Audit Sampling

##

## functional form: beta(α = 1, β = 30)

## parameters obtained via method 'sample'Priors based on a weighted earlier sample

You can integrate information from the previous year’s results,

adjusted by a factor (Derks et al., 2021),

into the prior distribution using method = 'power' in

conjunction with the x and n arguments. For

instance, the code below demonstrates how to include the data from the

previous year’s results (i.e., a sample of

= 58 items with

= 0 misstatements found), weighed by a factor of 0.7, into a beta prior

distribution. This factor delta of 0.7 could be derived

from the fact that 70 percent of the auditee’s contracts are with

businesses that have remained unchanged over the years, implying that

last year’s population is for 70 percent comparable to the population of

this year.

Note: This method requires the poisson,

binomial, or hypergeometric

likelihood.

auditPrior(method = "power", likelihood = "binomial", x = 0, n = 58, delta = 0.7)##

## Prior Distribution for Audit Sampling

##

## functional form: beta(α = 1, β = 40.6)

## parameters obtained via method 'power'Nonparametric prior distributions

You can establish the prior based on samples from the prior

distribution using method = 'nonparam' along with the

samples argument. For instance, the code below sets up a

prior based on 1000 samples from a beta(1, 10) distribution.

Note: The likelihood argument is not required and

will be ignored in this method.

auditPrior(method = "nonparam", samples = rbeta(1000, 1, 10))##

## Prior Distribution for Audit Sampling

##

## functional form: Nonparametric

## parameters obtained via method 'nonparam'Using a prior distribution

The objects returned by the auditPrior() function can be

used as input for the prior argument in both the

planning() and evaluation() functions. Here

follows a brief demonstration of how to construct the prior distribution

using these functions.

Planning a sample

The prior distribution can be employed during the planning stage to

compute a minimum sample size. This is done by supplying the object

returned by the auditPrior() function to the

planning() function via its prior argument.

For instance, the command below calculates the minimum sample size

required to test the misstatement in the population against a

performance materiality of five percent, using a beta(1, 10) prior

distribution. The resulting sample size is

= 49.

prior <- auditPrior(method = "param", likelihood = "binomial", alpha = 1, beta = 10)

planning(materiality = 0.05, likelihood = "binomial", prior = prior)##

## Bayesian Audit Sample Planning

##

## minimum sample size = 49

## sample size obtained in 50 iterations via method 'binomial' + 'prior'Evaluating a sample

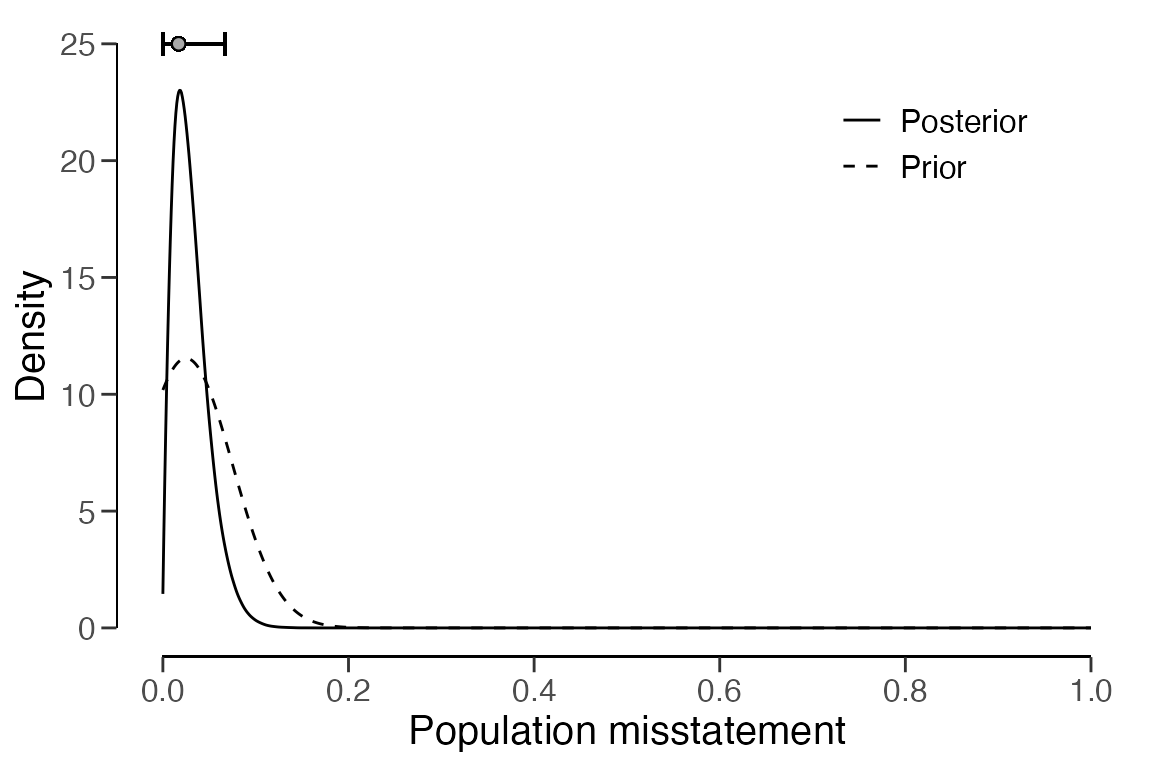

The prior distribution can also be used during the evaluation stage

by providing the object returned by the auditPrior()

function to the evaluation() function via its

prior argument. For example, the command below evaluates

the misstatement in the population with respect to a performance

materiality of five percent after observing a sample of

= 60 items with

= 1 misstatement, using a Normal(0.025, 0.05) prior distribution.

prior <- auditPrior(method = "param", likelihood = "normal", alpha = 0.025, beta = 0.05)

eval <- evaluation(materiality = 0.05, x = 1, n = 60, prior = prior)

summary(eval)##

## Bayesian Audit Sample Evaluation Summary

##

## Options:

## Confidence level: 0.95

## Materiality: 0.05

## Hypotheses: H₀: Θ > 0.05 vs. H₁: Θ < 0.05

## Method: poisson

## Prior distribution: normal(μ = 0.025, σ = 0.05)T[0,1]

##

## Data:

## Sample size: 60

## Number of errors: 1

## Sum of taints: 1

##

## Results:

## Posterior distribution: Nonparametric

## Most likely error: 0.018

## 95 percent credible interval: [0, 0.066]

## Precision: 0.048

## BF₁₀: 4.8232The prior and posterior distribution can be visualized by calling

plot(..., type = "posterior").

plot(eval, type = "posterior")

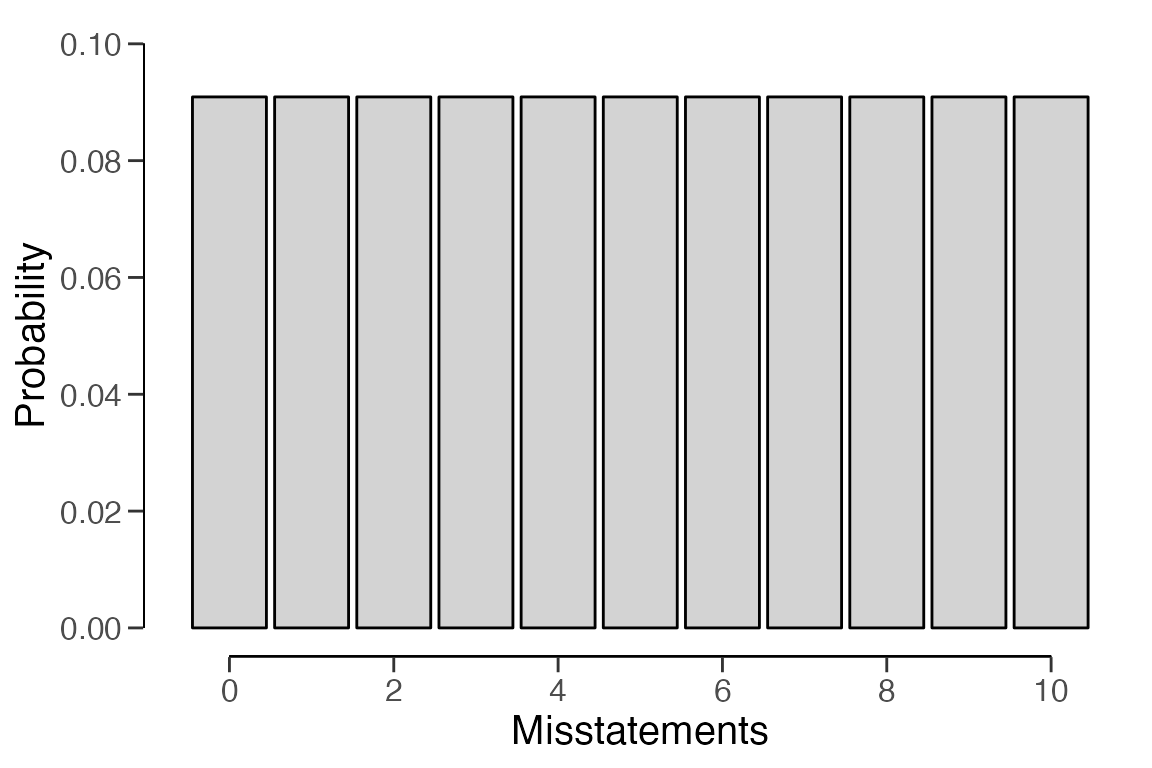

Furthermore, the predictions of the posterior distribution at the

data level can be visualized by combining the predict() and

plot() functions. For instance, the command below displays

the predictions of the posterior distribution for a hypothetical (next)

sample of

= 10 items.